Banking Panic of 1907: Nature of Crisis and the Creation of Federal Reserves

Today’s world gets defined by capitalism and globalization of markets. So, we get used to live with market economy: Stocks, commodity market, insurances, and so on. But, globalization of economic markets has a side effect: Financial crisis. We can easily see that since the beginnings of financial market, even early 16th century. In fact, financial crises have occurred in different scenarios. Essentially, we can distinguish them as follows: Sovereign defaults, hyperinflation, exchange rate crisis, and banking crisis. First two types of financial crisis are related to value of money which is associated to real market. It means, production factors might trigger this type of financial crisis, they are not related to financial system. Third one is manly associated to monetary outflows within a country according to which sudden money flow may affect balance of payments and liquidity squeeze. In this scenario, it has to be an authority to take into control the situation against which country is facing. Last one is the most dangerous and contagious type of financial crisis. If depositors lost their trust to banking system, they started to withdrawn their assets, and this situation leads to total collapse of banking system. According to Lloyd B. Thomas, in a banking crisis, large-scale defaults on bank loans induced by unexpected changes in underlying economic conditions systematically reduce the capital or net worth of numerous bank because of the fact that the predominant assets of the typical banks are its loans while its main labilities are its debts in the form of customers’ deposits and other borrowed funds. It means banking system is based on the leases and credits.[1]That’s why, to mitigate the effects of banking crisis, every country had tried to establish an institution through which market economy would be regulated and find necessary liquids to provide customers’ demand to withdrawn their money. For example, after Glorious Revolution in 1668, Businesses flourished, but the public finances were weak and the system of money and credit was in disarray. The goldsmith bankers, who had begun to develop the basic principles of banks as deposit-takers and lenders, had been damaged by the lax financial management of the Stuart kings[2]. Therefore, Bank of England established, market has regulated and trust of depositors to banks have been guaranteed and depositors and investors could foresee economic conditions. Like United Kingdom, United States have witnessed same crisis between 1819-1907 because of the fragmented banking system and lack of a central institution. To find a solution the destabilized banking system, in 1913, with Wilson’s efforts to form a central bank, Federal Reserves established. That’s sure that there were and are many banking crisis in economic history, but we are going to focus on a specific crisis: Banking panic of 1907 which led to creation of Federal Reserves. We have chosen this case because of the fact that banking panic of 1907 had own specificity in terms of private actors which played important roles during crisis. In absence of a central authority, who had regulated markets, how American economy had been able to manage this banking crisis? To examine this crisis, we’re going first look at internal and external dynamics behind the bank runs. Second, we’re going to analyse why this crisis has erupted and which personalities had influenced to get the dynamics up to a financial crisis. Third, we’re going to probe J.P. Morgan’s influence on the solution to stop bank runs. Finally, we’re going to observe creation of Federal Reserves.

- Dynamics Behind the Banking Panic of 1907

How did financial crisis begin? What prompted a panic? To answer these questions, we have to look at both internal and external dynamics which led to Banking Panic of 1907. First of all, we’re going to delve into internal dynamics. As we know, every country has own cultural consumption model which influences interest rates, velocity of money, and money demand. According to this fact, United States had own manner of consumption which was directly linked to interest rate in 1907 because of the fact that there was no central bank which regulates and stabilizes economy. So, we can easily contend that there were seasonal liquidity fluctuations before 1913. During the National Banking Era, the New York money market faced seasonal variations in interest rates and liquidity resulting from the transportation of crops from the interior of the United States to New York and then to Europe. The outflow of capital necessary to finance crop shipments from the Midwest to the East Coast in September or October usually left New York City money markets squeezed for cash. As a result, interest rates in New York City were prone to spike upward in autumn. Seasonal increases in economic activity were not matched by an increase in the money supply because existing financial structures tended to make the money supply “inelastic.”[3] According to M. Oliver M.W. Sprague, writing for National Monetary Commission in 1910,

This inelastic money supply has driven to liquidity squeeze[4].

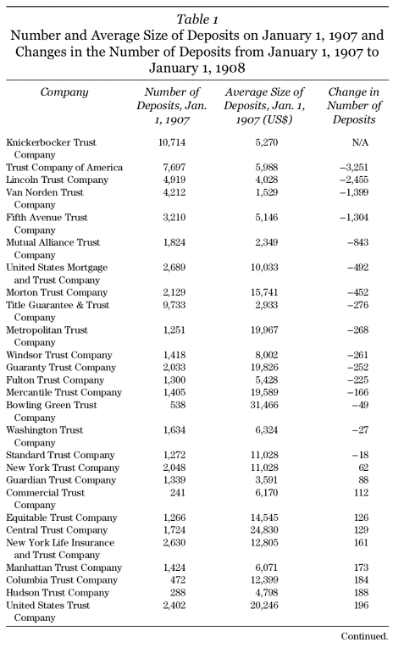

Second problem was regulation of trust company before 1907. Regulatory institutions did not prevent risky behavior. Consequently, trust companies took excessive risks, and excessive risk taking ultimately led to a loss of confidence in trust companies.[5] In fact, this view is neither completely wrong nor completely true. Before 1907, trust companies were regulated by Department of Treasury, but there was no restriction about type of customers so that banks could calculate and predict depositors’ behavior against financial stumble. Today, banks are controlled by Central Banks and some credit rating index organized by Fitch, Standard&Poor’s, and Moody’s. During bank runs, it can be easily noticed that uptown residential trust companies, such as Knickerbocker Trust Company, had failed because of the fact that their customers were merely households, who were rich, but deposited small amounts and were so grumbling and very skittish. According to Bradley A. Hansen, number of deposits in downtown trust companies actually increased at seventeen trust companies[6]. As shown in the table 1, we can easily say that Mr. Hansen’s view is clearly true. On the one hand, the first three company were located in Manhattan, uptown residential of New York. As we can see, they lost lots of their deposits and they felt into insolvency. On the other hand, the last three trust company were oldest trust companies, and they made business with long-term investors, such as industrial credits. Fourth reason, I assume, the most important reason, is complexity of trusts in United States. Basically, the function of trust companies is the creation of safe basket in which you can put all your financial intermediaries to be managed by professional traders. As Alexander Dana Noyes said that trust companies had several forms: Downtown trust companies, uptown trust companies, life insurance trust companies, title trust companies, and niche market trust companies[7]. Because of this complexity in the structure of Trust companies, they didn’t come to a term to get over the financial crisis between October 1907 to February 1

908. In addition to this disagreement amid trust companies, it was really difficult to set up a policy through which Department of Treasury could get informed financial market.

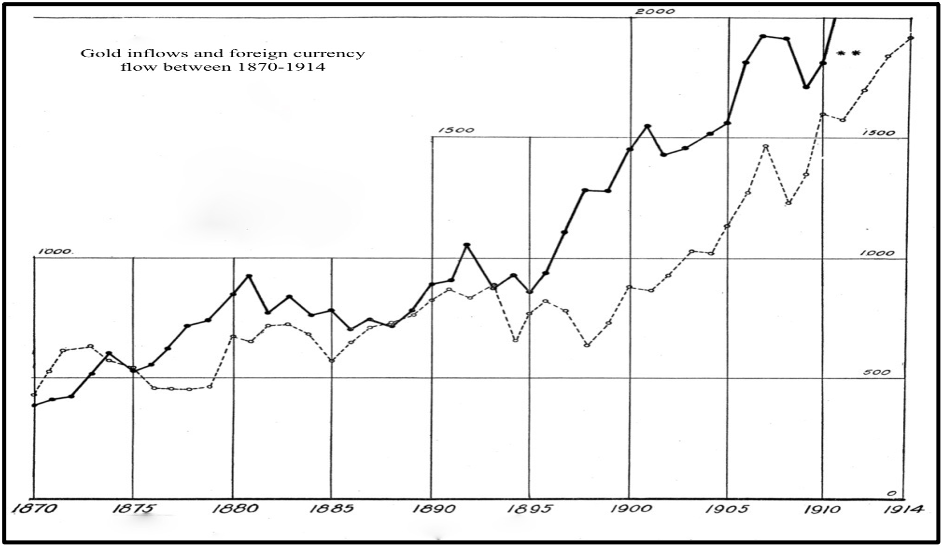

We have analyzed internal dynamics, but it’s not enough to understand whole picture in Banking Panic of 1907, unless we don’t examine external dynamics which were truly affected financial market in United States. First, we have to peek into gold flows between 1905 and 1907. In those years, money could be printed if you got gold because of the gold standard model before Bretton-Woods system. As we can see above, gold exports and imports were radically downward in 1907. Hard lines signify gold outflows and soft lines signify acquired British sterling by United States banks and companies between 1870-1914. [8]

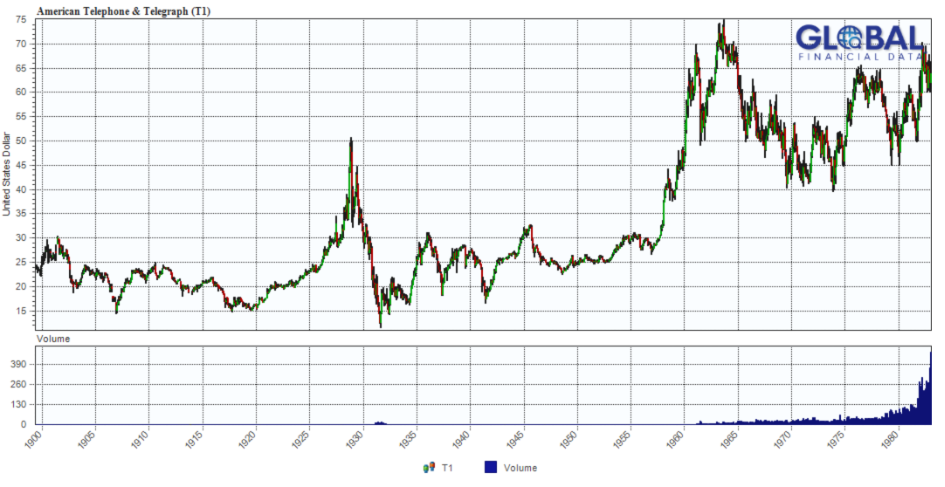

As we can see above, dramatic changes in terms of gold inflow shirked market. In general, United States import about $50 million dollar per year. But, finance bills were suspended during 1907, substantially constricting the system of arbitrage that minimized actual shipments of gold. In 1907, despite relatively high U.S. interest rates, the United States exported $30 million in gold to London during the summer. As a result, the New York money market was left with an uncharacteristically low volume of gold upon entering the fall season of cash tightness[9]. Second external factor is stock prices in global market. As we know, one of the main reason behind banking panic of 1907 was acute decline in copper prices in 1907. In fact, this slump in prices was not specifically in copper prices. Because of some conditions between 1900 and 1914, such as virtual increases through market operations, stock prices were overvalued. In 1907, economic bumble just blown and market could not adept itself as fast as commodities did. According to this graph, we can obviously observe this economic trend. As we seen below, between 1905-1907, stock prices in market have sharply up warded according to the stock beheld by American Telephone & telegraph. These can be easily explained by market operation as we said, such as short squeeze and corner the market.[10]

To sum up, both internal and external dynamics influenced on banking panic of 1907. Seasonal variation in interest rates affected banks reserves rates and their loans on call. And also, complex structure of Trust companies made difficult to come to a term to overpass this bank runs. In addition to these internal dynamics, external dynamics made unbalanced American economy through gold flows and stock prices which are directly linked to domestic and foreign investments. Nevertheless, we realized that if there was a central bank, which regulates market and control liquidities, Banking Panic of 1907 would not happened because of the fact that American banking system couldn’t find an extra resource to meet market’s needs in a short period. Therefore, we have to delve into nature of Banking Panic of 1907 to conceptualize what went wrong within this complex structure.

- Nature of Banking Panic of 1907

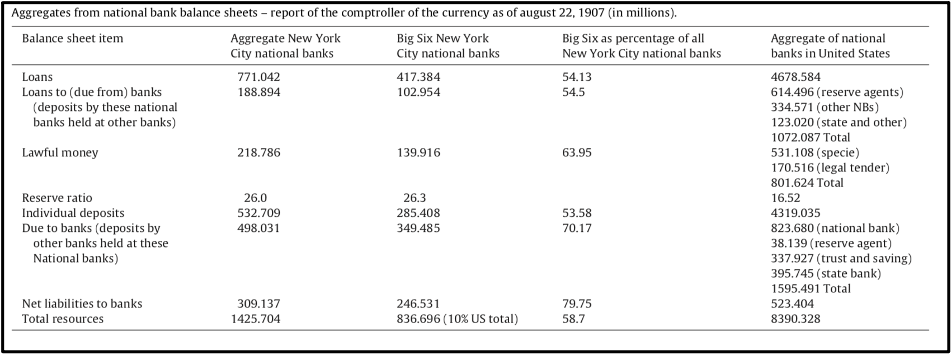

In this part, we insist on the fact that banking panic has erupted around some personalities, and this led us to search on an inclusive observation. That’s why, we have to take into account both market dynamics and influential personalities who shaped the trend of banking panic of 1907. First, we are going to take a glance at the most important person, who manipulated stock market, F. Augustus Heinze. On 14 October 1907, Heinze had tried to corner the copper stock market, but he has failed. In fact, this attempt to corner couldn’t affect whole market. In contrary, Heinze’s complex relations amid bankers and brokers have enlarged the effects of crisis –we will analyze that in below-. In addition, as we mentioned, money market was already tight during 1907. These factors provoked banking crisis, which sparked one of the severe bank panics of the National Banking Era. Contemporary observers like Sprague believed that the close associations between bankers and brokers heightened depositors’ anxiety[11]. In this case, F. Augustus Heinze had close relations with C.F. Morse, who was a director of seven New York City banks and there of which he controlled completely. Heinze, his brothers, and C.F. Morse were eager to use their monetary influence on market. They bought immense number of shares in the struggling United Copper Company back in Montana. In this plan, they will increase the prices of the United Copper. If the scheme worked, they would put other shareholders in solvency and made them rich. But they hadn’t known that Amalgamated Copper Mining Company, the main adversary of F. Augustus Heinze, have already short positioned in copper stocks. When Amalgamated Copper Mining Company has started to sell its stocks, copper price suddenly declined. Within two days, the price of United Copper decreased by more than 80 percent and the Heinze brothers suffered huge losses[12]. After this huge loss, Heinze strived to find a path to get rid of insolvency. As a solution, he decided to use his own bank, State Saving Banks of Butte, which was holding a large amount of collateral in forms of the shares of United Copper posted by those to whom the bank had granted loan. Heinze started to call loans. As a result, the loans went bad and the bank was declared insolvent[13]. News about insolvency of State Saving Banks of Butte provoked a massive run on Mercantile National Bank in New York, recently acquired by Heinze, which had a correspondent relationship with the Butte bank. According to Sprague, the assets of Heinze’s banks totaled $71 million dollar, compared over to $2 billion dollar in all New York City banks and trusts[14]. It was huge amount of assets in 1907 because of the fact that according to Treasury Department’s new regulation for local and national banks, the reserve ratio was %26 of their assets. In addition to the attacking Heinze’s banks, depositors withdrew a large amount of funds from trusts and banks owned by Morse[15]. In this chaotic situation, New York Clearing House promised to give $10 million fund to aid former Heinze banks sufficient because no notable run occurred on the banks[16] in condition that Otto and Augustus Heinze would resigned from their missions. They accepted that, and bail-out package released. On Monday, October 21, Mercantile National resumed business with new management, and the run ceased. After a while, uptown residential trust companies realized that depositors’ trust to financial intermediaries has gone. In fact, this was the real danger on banking system because of the fact that in 1906 New York State instituted a requirement that trust companies maintain their reserves at 15 percent of deposits, but only 5 percent of deposits needed to be kept as currency in the vault[17]. Trust riskier assets have failed due to unpredictable market conditions. Besides, New York Clearinghouse signaled to depositors that the trusts were likely to become insolvent during economic and financial downturn[18]. Aftermath of this signal, depositors have withdrawn their liquidities and this action affected stock markets. Value of stock has been depreciated by large-scale liquidation of call loans. It could be shown as a cynical cycle around financial market. At this time, New York Clearing house found a new solution to break up tight monetary policy: Clearinghouse loan certificates. The loan certificates helped prevent the need for costly liquidation of bank assets, like call loans – short term demandable loans backed by stock or bond collateral- in order to satisfy cash withdrawal demands or unfavorable clearing balances[19]. In below, you can easily see that to what extent monetary market was tight. Also, it can be understood by predicting the possible consequences of liquidity squeeze if this temporary solution hasn’t found out.

New York Clearinghouse’s new solution gave a breath to financial market because of the fact that New York Clearinghouse was legally prohibited from printing currency, and it was unable to sell or buy bonds in quantitates comparable to modern open market operations; therefore, they could not serve as legal reserves[20]. This solution was a temporary movement to get some time to get thing right. Eventually, domino effect had kept its pace, and banking crisis of 1907 have completely surrounded American financial market until mid-1908. In addition to financial market, New York City was also in debt. Short-term obligations of New York City were coming to due and the city had no funds with which to pay them. All these conditions which had occurred in New York City, might influence other financial market in the United States. At this point, a savior came the stage. In next part, we’re going to find out how this panic was handled and which actors have played central role.

Taken Actions to stop bank runs in 1907: J.P. Morgan and Big Six

As we have already mentioned, precautions taken by New York Clearing House and Treasury Department couldn’t cease to banking panic. Treasury Secretary Cortelyou said:

“By the consensus of opinion, Morgan was regarded as the leading spirit among businessmen who joined themselves together to meet the emergency… He was generally looked for to guidance and leadership”

From that point, we are going to look at one important person which led other bankers to point out an emergency plan: J.P. Morgan. Just before talking what he has accomplished during banking panic, we are eager to explain his background and his personality. John Pierpont Morgan was born into a distinguished New England family on April 17, 1837, in Hartford, Connecticut. One of his maternal relatives, James Pierpont was founder of Yale University; his paternal grandfather was a founder of the Aetna Insurance Company; and his father, Junius Spencer Morgan (1813-90) was a partner in a London-based merchant banking form. After graduated from high school, Morgan studied in Europe, and learnt French and German[21]. After all, he became founder of famous bank, J.P. Morgan. We have to explain his family and his educational background because of the fact that he used very well his social network to get over financial crisis. He was talent to connect the dots amid New York banks and trust companies. He saved country once during the 1895 gold crisis.

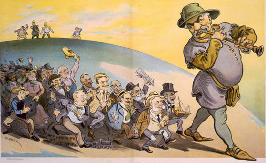

He bought U.S. Treasury bonds in exchange of gold because of the fact that U.S. government was in solvency due to lack of liquidity. He was regarded as greedy banker among politicians. This caricature explains us J.P. Morgan’s public image. American society said that Morgan has monopolistic idea to govern United States. In addition to his effort to save America, William McKinley was elected as the president of the United States of America in 1897. From that point, American people said that J.P. Morgan was the real president of the United States. This drawing show us how American society sees J.P. Morgan during the period of William McKinley. In fact, it is quite logic to emphasize that Morgan was prominent leader among bankers, but hatred figure among civilian in American society because of the fact that they believe J.P. Morgan seized all power, even he hasn’t been elected by public opinion. In case of banking panic of 1907, there were some dilemmas during the crisis. For example, Morgan refused to aid Knickerbocker Trust company on 22 October 1907, and after that, New York Times announced this decision. After a day, panic in financial market augmented. Bank runs up warded. At that time, Morgan had not tendency to help financial situation. At the background, this was a vengeance of J.P. Morgan because of the fact that Theodore Roosevelt cancelled Morgan’s initiative, called Northern Securities in 1901.

Roosevelt thinks that J.P. Morgan has already controlled %60 of American steel and %75 of American railway production. If Pierpont Morgan control also securities, no one would stop Morgan to reign in United States. But, two days later on 25 October 1907, New York Times announced that Morgan will organize support for Trust Company of America[22]. Morgan’s sudden turn in his earlier decision had a reason: Roosevelt sent him 25 million dollars to cease panic in financial market.[23] And also, Roosevelt guaranteed that the seal over Northern Securities will be taken off. At the same time, New York Clearing House announced loan certificates through which velocity of money and money supply would be increased. These precautions were implied. In this case, a decision, which was really important in public opinion, was carrying the money in by vault Wall Street. Depositor saw that, and they though that governance of finance was safe and sound. As a result, at the beginning of December, panic have almost ended. However, these precautions were temporary due to the fact that board of finance haven’t aimed to fix structural problems such as depositors’ character in uptown residential trust companies. As a consequence, big bank runs in other trust companies, such as Lincoln Trust Companies, got flamed. Now, it was the time that Morgan really got in the business. But, there was a crucial question: Why and how a private banker wants to resolve a financial crisis? Why he will take the responsibility? On the one hand, other bankers were suspicious about J.P. Morgan because of the fact that as we saw in earlier stage of this financial crisis, Morgan’s decisions were unpredictable. He refused to aid Knickerbocker, and after two days he organized a support to Trust Company of America. The bankers thought that Morgan might take into account his private interest instead of public good. On the other hand, J.P. Morgan was the only person, who could stop this bank run and who has 68 million dollars in 1908[24]. In fact, this part of crisis was more complex and much more interesting to understand the role of J. Pierpont Morgan. This part is much more about Moore&Schley Brokerage House which has around 100 million dollar assets[25]. In addition to this strong financial look, structure of these assets was so risky because of the fact that more than %50 of these assets was associated to iron and steel companies. Other important issue about Moore&Schley was the fact that if it failed, it would rock the stock market and might bring down according to J.P. Morgan[26]. In fact, all the quarrel was blown up by a single news about iron and steel production. November 2, New York Times have written that iron and steel companies will show declining performance in 1908, and that will lead to insolvency in the companies with which they have the economic ties. As we said, J.P. Morgan has %60 of American steel industry and ¾ of railway industry; that’s why, bailing out of Moore&Schley was vital for J.P. Morgan. Therefore, at this night, he arranged two meetings in his Library. Benjamin Strong of the Bankers Trust, Edward King of Union Trust, and heads of several other companies were summoned for a talk in the West Room[27]. Morgan said that if they won’t save Moore&Schley, Trust of America will fail and which will influence entire trust market. To thwart this massive failure, Morgan demanded extra 25 million dollars. In another room, East Room, Morgan had assembled Baker, Stillman, and other bank presidents, who were soon joined by Frick and Judge Garry representing the finance committee of U.S. Steel[28]. Morgan asked his plan about buying T.C.&I. (the Tennessee Coal and Iron Company) stock which has strong relations with Moore&Schley, and this buying was necessary to bail out whole brokerage market. For this, Morgan wanted extra 18 million dollars. These two bold decisions have to be made before Exchange market opening, it means before Monday. Morgan said that and left the office. While two groups debated their perspective but allied problems, Morgan locked the doors and went to his private room to play Solitaire. Debates took about 4 hours and early hours of dawn, Morgan entered the room and asked what is the final decision about bailing out Moore&Schely and T.C.&I. They agreed about Moore&Schley, but not about T.C.&I. Morgan said that is unacceptable because of the fact that they have strong economic lies, such as loans and shares. After that, Ben Strong went to Washington D.C. to negotiate with Roosevelt to buy T.C.&I.’s shares. At the night of November 3, these two committee have met again to say their financial decision. Stillman, Baker, and Grant Schley were in the West Room. They waited Morgan to push him to reach a consensus among head of trust companies and banks. At this time, the Rockefellers attended the meeting and were eager to come to term with these guys. Henry Frick, proposed direct loan to Moore&Schley because of the antitrust prosecution of U.S. Steel if they failed to consult with the White House[29]. Frick was clever. If Morgan operates a full-scale takeover, Morgan could be accused to set up steel cartel to determine steel prices. Everyone in the West Room was nervous to wait President’s decision. Suddenly, the telephone rang at 9.55. Theodore Roosevelt agreed not to take any action to oppose the purchase of the T.C.&I. stock by United States Steel. Immediately, bankers released this news to Wall Street by declaring that there is no more threat to bankrupt any company. For the first time in weeks, banks, trust companies, and brokers felt almost secure[30]. As a result, Morgan’s ruthless exercise of centralized control had done successfully. The force sale of T.C.&I. stock for around 50 million dollars would ultimately enrich the steel trust tenfold, without comforting investors ruined by the failure of the Knickerbocker and several small banks[31]. Next day, November 5, the New York Times published articles that painted Morgan as the hero of the 1907 Panic, “Old Man” who looked out or American’s financial system[32]. Also, At the 139th Chamber of Commerce of the State of New York Annual dinner, Senator Spooner named Morgan the “uncrowned king” of financiers[33]. To sum up, we can easily say that Morgan’s role is too similar to central bank. He made contact with other actors in finance market and tried to find a common point among them. Also, he bought T.C.&I. as central banks bails out the firms which are insolvency. Morgan’s act during the panic showed that United States need a central bank which regulate the market with judiciary rules, not like a private investor such as John Pierpont Morgan.

Creation of Federal Reserves

In the spring of 1908, US Congress have promulgated Aldrich-Vreeland Act according which National Monetary Commission established. Its mission was investigating the causes for periodic banking panic, almost every 10 years. Senator Nelson Aldrich, chairman of National Monetary Commission, departed for Europe to analyze how Bank of England and Banque de France work in times of crises. When he returned to United States, he held a secret conference of top banking authorities in November 1910, in Georgia. The final report of the National Monetary Commission was submitted in early 1911. But unfortunately, Congress couldn’t propose a new central bank due to the debates about juridical limitation and scale of relations among real sector and finance market. The main debate was division of power over decision-making in the proposed central bank between the government and the private sector, between rural and urban interests, and among bankers, nonbank business, and rest of society. The final draft represented an acute balance these competing interests.[34] On December 22, 1913, Congress passed the Federal Reserve Act. President Woodrow Wilson signed the legislation the same day. After more than 135 years in existence, the United States now had a permanent central bank. Thanks to banking panic of 1907 and to John Pierpont Morgan’s efforts, the United States understood the importance of an institution which regulates competing interests among financial actors and learnt how to balance them via a central authority. Also, there will be no more need to temporary solution such as New York Cleaning House certificate loans to increase money supply to get rid of liquidity squeeze.

Conclusion

The Banking Panic of 1907 has a unique stance in economic history. A private investor played as central banks to bring down the fever of stock market. To comprehend what happened in 1907, we looked at, first, the preconditions of the crisis which was manipulated by both internal and external drivers. In absence of central banks, these signals couldn’t be evaluated in the United States, and it led to disastrous panic in trusts and stocks. Second, we examined the nature of crisis by regarding some data from U.S. Treasury. We witnessed that corner the market attempts couldn’t be intervened by an institution through which other investors could foresee the conditions and trust the stability of market in time of fluctuant transactions in market. Also, we observed another important role of central banks, which is augmenting money supply to get over a squeeze because of the reserve ratio and immediate withdrawal demand coming from depositor under which liquidity problem is immense to handle. Third, we treated a person, John Pierpont Morgan, who assumed himself as a bridge to get communicate other financial actors. As we saw, many meetings were organized by Morgan to find a consensus among the bankers and head of trust companies. Under normal circumstances, this duty belongs to central banks. Nevertheless, the United States had no central bank to take responsibility. Also, we witnessed Morgan’s attitude to handle this crisis: Both he kept in mind his private interests and emotions, such as vengeance to Roosevelt and gain in steel market, and he took into account national interests during the 1907 Panic. This experience showed also us the necessity of impersonal establishment which has no private interest and sentiments about actors. At the end, we touched briefly the creation of Federal Reserve which says us the fact that the United States took lesson from the banking panic of 1907. As a final thought, I can say that John Pierpont Morgan’s performance to deal this crisis was an enormous success story. However, we couldn’t leave all these powers to a man. That’s why, this case shows us the importance of institutions in the governance of national economy.

Bibliography

Bank of England, History of the Bank of England, retrieved from http://www.bankofengland.co.uk/about/Pages/history/default.aspx on 12 October 2017

Bullock, C. (1919). The History of our Foreign Trade Balance from 1789 to 1914. The Review of Economics and Statistics, 1(3), 216-233

Friedman, M. & Anna Jacobson Schwartz (1963). A Monetary History of the United States 1867-1960. Princeton, New Jersey: Princeton University Press, p888

Global Financial Data, American Telephone & Telegraph, retrieved from https://www.globalfinancialdata.com/databases/Graphs/ATT.png on 13 October 2017

Goodhart, C. (1969). The New York Market and Finance of Trade, 1900-1913. Cambridge, Massachusetts: Harvard University Press, 248

Hansen, B. (2014). A Failure of Regulation? Reinterpreting the Panic of 1907. Business History Review, 88(3), 545-569

Jackson, S. (1984). J.P. Morgan: The Rise and Fall of a Banker. London; Melbourne: Heinemann, 332

Moen, J. & Ellis Tallman. (1990) Lessons from the Panic of 1907. Economic Review of Federal Reserve Bank of Atlanta, 3, 2-13

Moen, J. & Ellis Tallman (1992). The bank panic of 1907: the role of trust companies. The Journal of economic History, 52(3), 611-630

Noyes, A. (2017). Forty Years of American Finance: A Short Financial History of the Government and People of the United States since Civil War 1865-1907. London: Forgotten Books, p446

Peeler, K.J. (2010). The rise and fall of J. Pierpont Morgan: the shift in John Pierpont Morgan’s public image from the bailout of Moore&Schley Brokerage House in 1907 to Pujo Hearings in 1913 (Working Paper). Retrieved from Harvard University website on 16 October 2017 : https://sites.fas.harvard.edu/~histecon/crisis-next/1907/docs/Peeler-Rise_and_Fall.pdf

Sprague, O.M.W. (1908). The American crisis of 1907. The Economic Journal of Federal Reserve Bank of Atlanta, 18(71), 353-372

Thomas, Lloyd B. (2013). The financial crisis and Federal Reserve policy. New York, NY: Palgrave Macmillan, 269

[1]Thomas, Lloyd B. The Financial Crises and Federal Reserve Policy, p11.

[2] http://www.bankofengland.co.uk/about/Pages/history/default.aspx

[3] Lessons from the Panic of 1907

[4] The American Crisis of 1907

[5] The Role of Trust Companies, Jon Moen and Ellis W. Tallman

[6] A failure of Regulation? Reinterpreting the Panic of 1907

[7] Alexander Dana Noyes, Forty Years of American Finance: A Short Financial History of the Government and People of the United States since Civil War, 1865-1907 (New York, 1909), p370

[8] History of our Foreign Trade Balance from 1789 to 1914.

[9] Lessons from the Panic of 1907

[10] https://www.globalfinancialdata.com/databases/Graphs/ATT.png

[11] Lessons from the Panic of 1907

[12] Financial Crisis and Federal Reserve Policy, p39

[13] Friedman, Milton and Anna I. Schwarz. A Monetary History of United States: 1867-1960. Princeton, N.J: Princeton University Press, 1963.

[14] Sprague

[15] Financial Crisis and Federal Reserve Policy, p40

[16] Lessons from the Panic of 1907

[17]Goodhart, C. The New York Money Market and Finance of Trade, 1900-1913.

[18] Lessons from the Panic of 1907

[19] Tallman, E and Jon Moen. Liquidity creation without a central bank: Clearing house loan certificates in the banking panic of 1907, p1

[20] Ibid, p2

[21] History, http://www.history.com/topics/john-pierpont-morgan

[22] FED Boston

[23] https://www.youtube.com/watch?v=vyV_RNh_Aow

[24] Ibid

[25] J.P. Morgan: Rise and Fall of a Banker, p270

[26] Ibid, p272

[27] Ibid, p273

[28] Ibid, p273

[29] Ibid, p274

[30] Ibid, p275

[31] Ibid

[32] Peeler, K.J. The rise and fall of J. Pierpont Morgan: the shift in John Pierpont Morgan’s public image from the bailout of Moore&Schley Brokerage House in 1907 to Pujo Hearings in 1913, p5

[33] Ibid, p6

[34] The Financial Crisis and Federal Reserve Policy, p41-42